Welcome to The LF Business Suite

Welcome to the LF Business Suite—your one-stop destination for fast, effective solutions to your most urgent financial challenges. No commitment required!

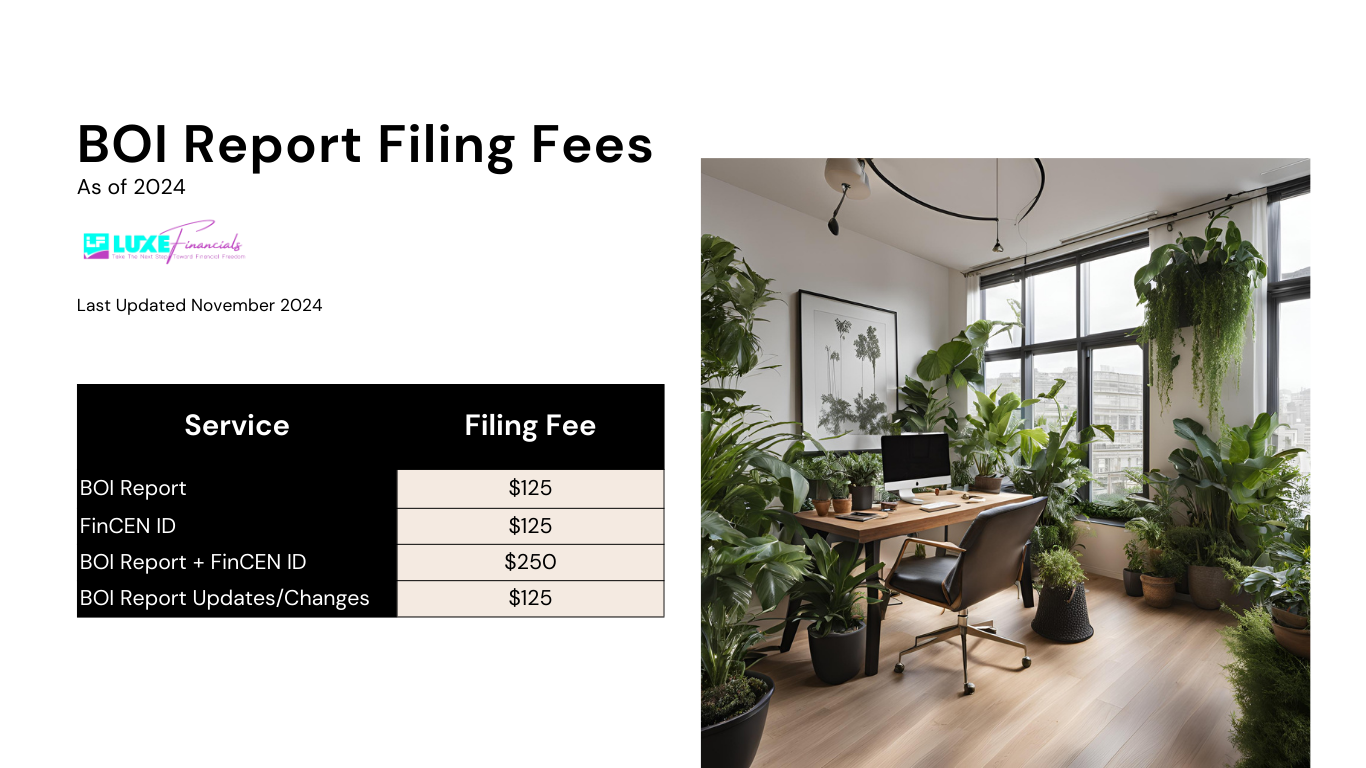

Beneficial Ownership Information Report (BOIR)

BOI reporting ensures business transparency by requiring single-member LLCs, sole proprietors, and Corporations to disclose ownership details in compliance with federal law. Avoid penalties with our BOI Filing Service, which makes compliance simple and worry-free

As of February 19, 2025, filing is required.

As of March 2, 2025, the U.S. Treasury Department will not enforce any penalties or fines associated with beneficial ownership information reporting. Scroll down to the News section to read more.

As of March 24, 2025, FinCEN has issued an interim final rule that removes the requirement for U.S. companies to adhere to beneficial ownership information (BOI) reporting requirements. See below for more details.

The rule now only mandates BOI reporting from foreign entities registered to do business in the U.S., effectively exempting all U.S.-created companies and their beneficial owners.

What is BOI Reporting?

BOI reporting requires certain businesses who are “reporting companies” to disclose ownership details, promoting transparency and compliance with federal anti-money laundering regulations.

Who Needs to File BOI Reports?

Single-member LLCs, sole proprietors, partnerships, and corporations may need to file a BOI report to stay compliant and avoid costly penalties.

Our BOI Filing Process

Our process is simple: we guide you from document collection through filing, ensuring everything is accurate and submitted on time.

Why Choose Us?

With years of experience in compliance and accounting, we make BOI reporting stress-free, so you can focus on your business.

*Please note that the LF service fee applies to each individual filing submitted.

Hiring Us to File

Your BOI Report Is Fast and Easy!

Forming your LLC with us is a streamlined and efficient process. Here’s how it works:

1. Sign Up

Click on the “File BOI” button below, fill out a brief form with some basic details about your business, and complete your payment. It’s that simple.

2. Get Approved

We’ll take care of submitting your Beneficial Ownership Information based on the documents and information you provided and will submit them to FinCEN through their filing portal for approval.

3. It’s Official

Once your BOI Report filing is approved by FinCEN, we’ll notify you immediately. At this point, your BOI Report is officially filed, and you can move forward with including this information in your records. Once you receive approval, you’ll receive copies of all documents.

BOI Report FAQ's

A beneficial ownership information report is a document that identifies the individuals who own or control a company.

Filing this report helps ensure transparency and compliance with legal requirements, preventing fraud and money laundering.

A beneficial owner is any individual who directly or indirectly owns or controls a significant percentage of the company, typically 25% or more.

- A unique business name

- A registered agent and address

- LLC Articles of Organization

- An Employer Identification Number (EIN) if you plan to hire employees or open a business bank account

The report generally requires details such as the beneficial owner’s name, date of birth, address, and the nature of their ownership or control.

The frequency of filing can vary by jurisdiction, but it is often required annually or whenever there are changes in ownership.

Failure to file the report can result in penalties, fines, and potential legal action against the company.

Fines of $500/day, up to $10,000, and 2 years in prison may apply.

The report can usually be filed online through the Financial Crime Enforcement Network (FinCEN) website.

Yes, you can update the information if there are changes in the beneficial ownership details.

- The confidentiality of the information depends on the jurisdiction, but generally, it is protected and only accessible to authorized entities.

You can visit fincen.gov/boi for more information and resources. See below!

*The content provided here is for informational purposes only and should not be considered legal advice or a replacement for professional legal counsel. This information is not intended to establish, nor does your access to or use of it create, an attorney-client relationship or an accountant-client relationship. For more details, please refer to our Terms of Service.

Beneficial Ownership Information

Report Resources

Click the link to be taken to the resource!

- Luxe Financials BOI Reporting Guide

- FinCEN Beneficial Ownership Information Official Website

- FinCEN Beneficial Ownership Information Report (BOIR)

- FinCEN BOI Filing Instructions

- FinCEN Frequently Asked Questions

- FinCEN Reporting Requirements: Small Entity Compliance Guide

- Corporate Transparency Act

- FinCEN ID Application for Individuals

Beneficial Ownership Information

News Updates

March 24, 2025

Treasury Halts BOI Reporting Penalties for U.S. Businesses

FinCEN’s interim final rule amends the Corporate Transparency Act, now requiring only foreign entities registered to do business in the U.S. to report beneficial ownership information (BOI). New deadlines apply to foreign entities based on their registration date. FinCEN is immediately halting enforcement of BOI reporting penalties against U.S. citizens and domestic companies.

Have questions about what this means for your business? Contact us today!

—————————————–

March 2, 2025

Treasury Halts BOI Reporting Penalties for U.S. Businesses

The U.S. Treasury Department has announced a major shift in Beneficial Ownership Information (BOI) reporting requirements under the Corporate Transparency Act. Treasury will not enforce any penalties or fines for BOI reporting—both under current deadlines and after future rule changes take effect.

Even more notably, Treasury plans to limit BOI reporting to foreign reporting companies only, removing the requirement for U.S. businesses and their owners. This move is designed to reduce regulatory burdens and support small businesses.

Treasury Secretary Scott Bessent called this change “a victory for common sense”, reinforcing the administration’s commitment to cutting unnecessary red tape and boosting economic growth.

This decision marks a significant win for U.S. entrepreneurs, easing compliance concerns and allowing businesses to focus on growth. Stay tuned for further updates as new rules take shape.

Have questions about what this means for your business? Contact us today!

—————————————–

February 19, 2025

Following a February 18, 2025, ruling by the U.S. District Court for the Eastern District of Texas, beneficial ownership information (BOI) reporting requirements under the Corporate Transparency Act (CTA) are once again in effect. However, the Department of the Treasury recognizes that businesses may need additional time to comply. As a result, the Financial Crimes Enforcement Network (FinCEN) has extended the reporting deadline by 30 days, making March 21, 2025, the new deadline for most reporting companies.

Additionally, FinCEN is reviewing options to further ease compliance for lower-risk entities, including many U.S. small businesses. Companies with later reporting deadlines, such as those qualifying for disaster relief extensions, should continue following their assigned deadlines.

For more details on BOI reporting requirements and exemptions, visit FinCEN’s official website.

—————————————

December 27, 2024

As of December 27, 2024 the Financial Crimes Enforcement Network (FinCEN) released the following statement:

“In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports.”

The alert goes on to say:

“On December 26, 2024, however, a different panel of the U.S. Court of Appeals for the Fifth Circuit issued an order vacating the Court’s December 23, 2024 order granting a stay of the preliminary injunction. Accordingly, as of December 26, 2024, the injunction issued by the district court in Texas Top Cop Shop, Inc. v. Garland is in effect and reporting companies are not currently required to file beneficial ownership information with FinCEN.”

To read the full report, click here.

Source: FinCEN

—————————————

December 23, 2024

As of December 23, 2024 the U.S. Court of Appeals for the Fifth Circuit overturned the injunction placed on December 3, 2024.

Beneficial Ownership Information Report Filing is now required and the deadline is still on for January 1, 2025.

(Source: National Law Review)

New Filing Deadlines (Source: FinCEN)

- Reporting companies that were created or registered prior to January 1, 2024 have until January 13, 2025 to file their initial beneficial ownership information reports with FinCEN. (These companies would otherwise have been required to report by January 1, 2025.)

- Reporting companies created or registered in the United States on or after September 4, 2024 that had a filing deadline between December 3, 2024 and December 23, 2024 have until January 13, 2025 to file their initial beneficial ownership information reports with FinCEN.

- Reporting companies created or registered in the United States on or after December 3, 2024 and on or before December 23, 2024 have an additional 21 days from their original filing deadline to file their initial beneficial ownership information reports with FinCEN.

- Reporting companies that qualify for disaster relief may have extended deadlines that fall beyond January 13, 2025. These companies should abide by whichever deadline falls later.

- Reporting companies that are created or registered in the United States on or after January 1, 2025 have 30 days to file their initial beneficial ownership information reports with FinCEN after receiving actual or public notice that their creation or registration is effective.

- As indicated in the alert titled “Notice Regarding National Small Business United v. Yellen, No. 5:22-cv-01448 (N.D. Ala.)”, Plaintiffs in National Small Business United v. Yellen, No. 5:22-cv-01448 (N.D. Ala.)—namely, Isaac Winkles, reporting companies for which Isaac Winkles is the beneficial owner or applicant, the National Small Business Association, and members of the National Small Business Association (as of March 1, 2024)—are not currently required to report their beneficial ownership information to FinCEN at this time.

—————————————

December 3, 2024

As of December 3, 2024, in the case of Texas Top Cop Shop v. Garland et al. “the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction against the enforcement of the Corporate Transparency Act (CTA)” (Source: Forbes).

All filing of Beneficial Ownership Information has ceased until further notice.