Welcome to The LF Business Suite

Welcome to the LF Business Suite—your one-stop destination for fast, effective solutions to your most urgent financial challenges. No commitment required!

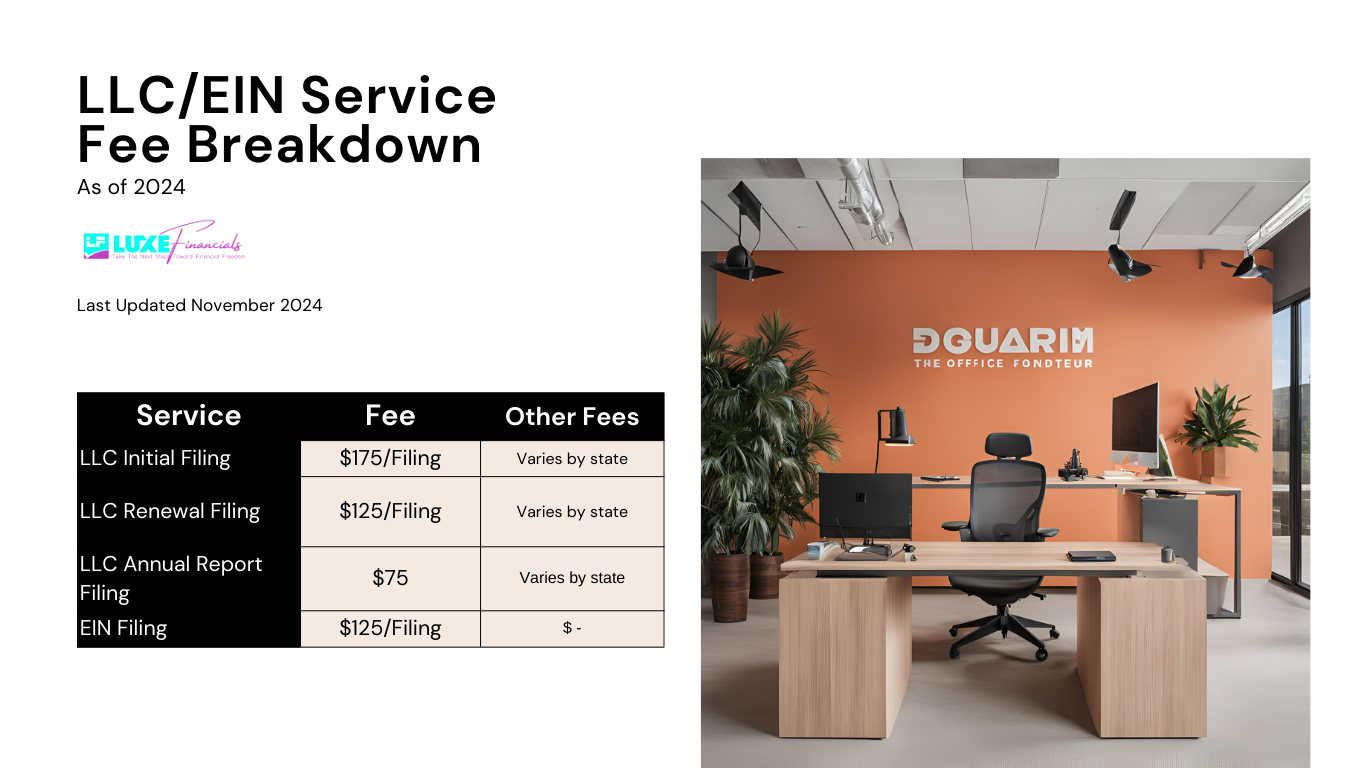

LLC Filing Services

Starting a business can be overwhelming, but we’re here to make it easier for you. At Luxe Financials, we specialize in providing comprehensive LLC Filing services that cover everything you need to get your business up and running.

LLC

Filing

Get your LLC formed quickly and efficiently with our expert filing services. We handle the paperwork, so you don’t have to.

Our service fee starts at just $175 plus the applicable state filing fee.

LLC Renewal

Filing

Keep your LLC in good standing year after year with our Annual Renewal and Document Management services. This comprehensive service includes managing your filing documents and handling your annual renewal for $125.

LLC Annual

Report Filing

Stay compliant with state regulations and avoid penalties by filing your Annual Report on time. We offer Annual Report filing services for $75 plus the state filing fee.

EIN

Filing

Need an Employer Identification Number (EIN) for your LLC? We can help you obtain an EIN from the IRS with ease. Our EIN filing service is available for $125.

*Please note that the LF service fee applies to each individual filing submitted.

Hiring Us to Form

Your LLC Is Fast and Easy!

Forming your LLC with us is a streamlined and efficient process. Here’s how it works:

1. Sign Up

Click on the “File LLC” button below, fill out a brief form with some basic details about your business, and complete your payment. It’s that simple.

2. Get Approved

We’ll take care of preparing your Articles of Organization and submit them to the relevant state agency for approval.

3. It’s Official

Once your LLC filing is approved by the state, we’ll notify you immediately. At this point, your LLC is officially formed, and you can move forward with the next steps—like obtaining an EIN and opening a business bank account. Once you receive state approval, you’ll receive copies of all documents.

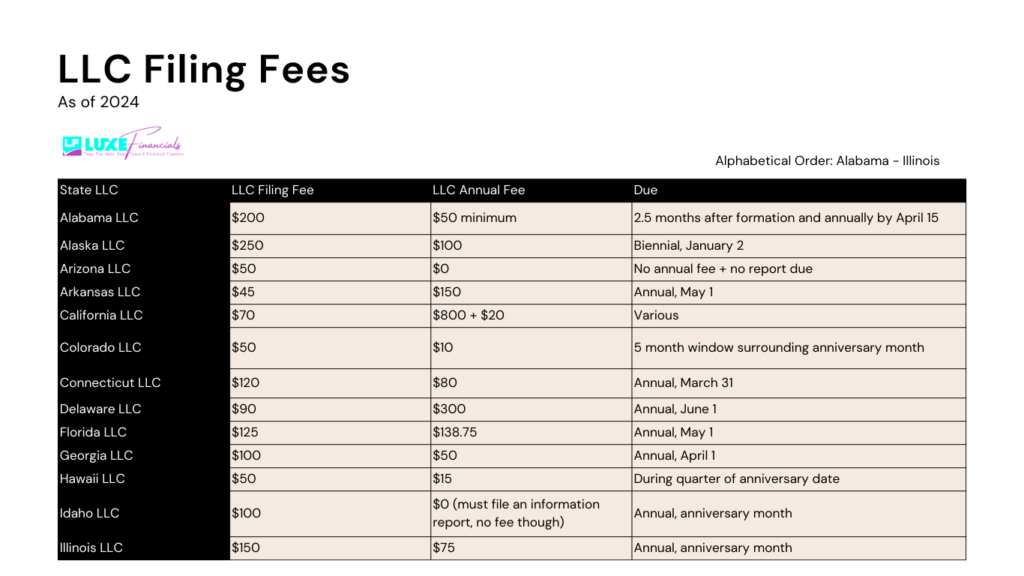

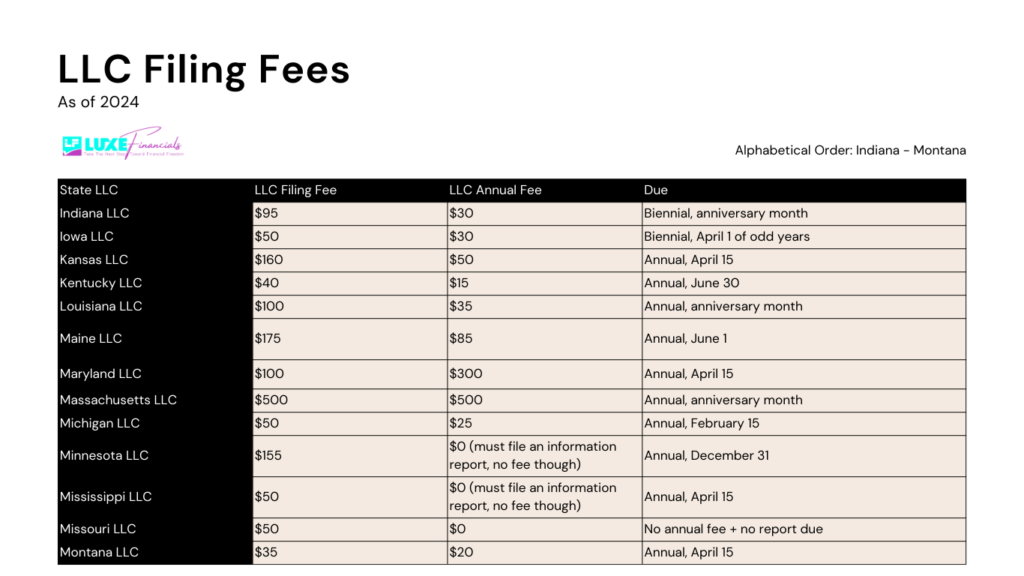

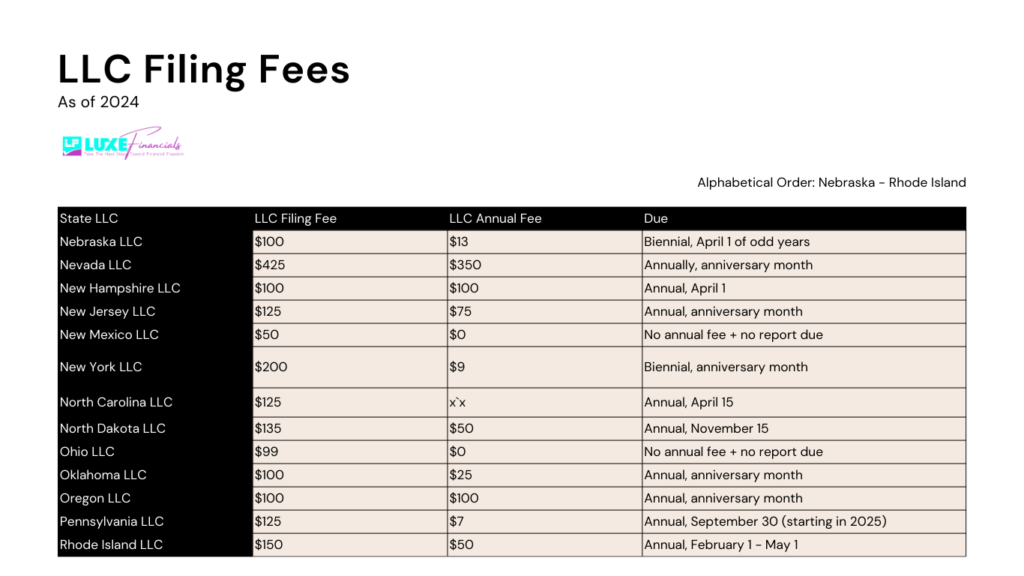

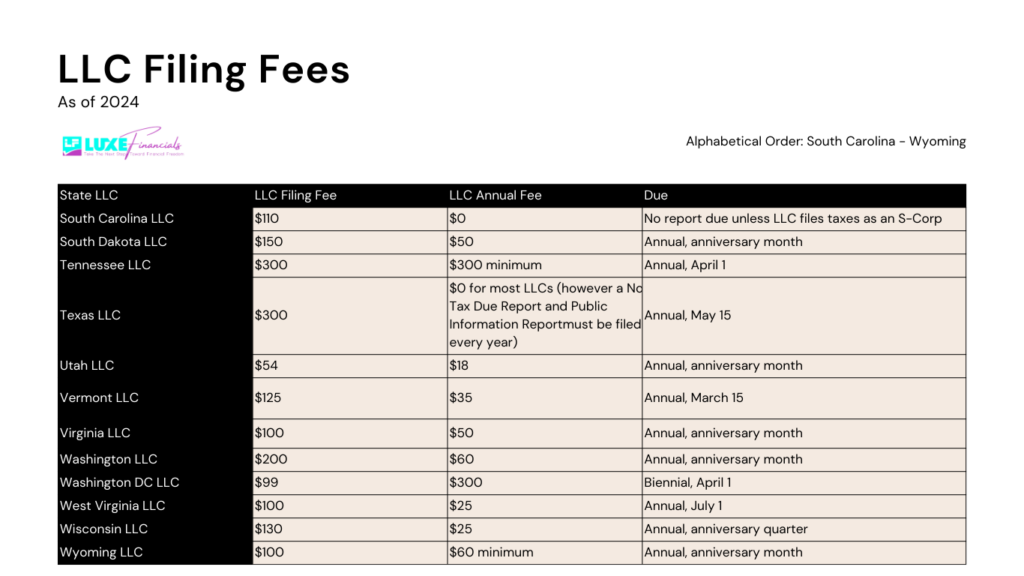

LLC Filing Fees by State

How to Start an LLC

1

Designate a Registered Agent

To legally form an LLC, you must appoint a registered agent. This individual or service will receive important legal documents and government notices on behalf of your business. The registered agent’s information, including their physical address, will be included in your LLC formation paperwork.

Because the registered agent’s role is crucial, it’s important to choose someone you trust to handle sensitive communications promptly and reliably. If you prefer to keep your personal address private, consider hiring a professional registered agent service.

2

Choose Your LLC Name

Selecting a name for your LLC is an essential step in the formation process. The name must be unique and compliant with state regulations, including the use of specific business identifiers such as “LLC” or “Limited Liability Company.” Most states offer an online tool to check the availability of your desired business name.

Be sure to avoid restricted words or phrases that may require additional paperwork or approval.

3

File LLC Articles of Organization

After choosing a name, the next step is to file your LLC’s Articles of Organization with the Secretary of State or relevant state agency. This document officially registers your LLC with the state and typically requires basic information such as your LLC’s name, the registered agent’s details, and a signature.

4

Obtain an EIN

Once your LLC is formed, you’ll need to obtain an Employer Identification Number (EIN) from the IRS. This federal tax ID is essential for tax filing, opening business bank accounts, and hiring employees.

An EIN helps establish your LLC’s identity separate from your own, which is important for maintaining limited liability.

5

Create an LLC Operating Agreement

An LLC Operating Agreement is a critical internal document that outlines the ownership structure, management responsibilities, and operational procedures of your LLC.

Although not always required by state law, having an operating agreement is highly recommended as it helps prevent disputes among members and provides clarity on how the business should be run.

6

File a Beneficial Ownership Information Report

Beginning January 1, 2024, most LLCs will need to file a Beneficial Ownership Information (BOI) Report with the Financial Crimes Enforcement Network (FinCEN). This report, required within 90 days of forming your LLC (or within 30 days for those formed after 2025), includes detailed information about your LLC’s beneficial owners—individuals with significant control or ownership of the company.

The BOI Report is not public but will be used by government and financial institutions to verify identities.

7

Open a Business Bank Account

To preserve the limited liability protection of your LLC, it’s crucial to keep your personal and business finances separate. One of the first steps is to open a dedicated business bank account for your LLC. This separation is essential because courts may examine whether you’ve kept your personal and business assets distinct when deciding whether to uphold your LLC’s liability shield or allow personal liability for business debts.

To open a business bank account, you’ll typically need to provide the following documents:

- Articles of Organization

- Operating Agreement

- Employer Identification Number (EIN)

Depending on your bank’s policies and the clarity of authority outlined in your LLC’s governing documents, you might also need an LLC resolution authorizing the opening of the account.

8

Fund Your LLC

Once your business bank account is open, it’s time to fund your LLC with initial capital contributions. This involves depositing money into the LLC’s account to cover startup expenses and operational costs.

For example, if your business requires $10,000 to get started, each member would contribute their share of the total amount from their personal funds or assets. In return, members receive a proportional percentage of ownership in the LLC, known as membership interest.

Contributions can be adjusted later if members decide to invest additional capital. Proper documentation of these transactions is vital to maintain clear financial records.

9

File State Reports & Taxes

After forming your LLC, your state may require you to submit periodic reports or renewals to keep your business in good standing. These requirements vary by state and may include annual or biennial reports that confirm or update your LLC’s information. Some states also combine these reports with other obligations, such as franchise taxes.

For instance, Arkansas combines its annual report with an annual franchise tax, while states like Washington and Nevada require LLCs to file an initial report shortly after formation.

Additionally, many states have specific tax filing requirements for LLCs, including informational filings and various types of state taxes.

LLC and EIN FAQ's

An LLC (Limited Liability Company) is a business structure that provides personal liability protection to its owners (called members). This means that members’ personal assets, such as homes and cars, are generally protected from business debts and liabilities. LLCs are also flexible in terms of management and tax treatment, making them a popular choice for small businesses.

Forming an LLC can protect your personal assets from business liabilities, provide tax flexibility, and enhance your business’s credibility. It also allows for easier management and less formal paperwork compared to corporations.

To form an LLC, you’ll typically need to provide the following:

- A unique business name

- A registered agent and address

- LLC Articles of Organization

- An Employer Identification Number (EIN) if you plan to hire employees or open a business bank account

The timeframe for forming an LLC varies by state, but it typically takes anywhere from a few days to a few weeks. We’ll expedite the process as much as possible and keep you informed throughout.

An EIN (Employer Identification Number) is a federal tax ID number issued by the IRS. It’s required for businesses that plan to hire employees, open a business bank account, or file certain tax returns. An EIN helps separate your business’s tax identity from your personal identity.

Yes! As part of our services, we can apply for an EIN on your behalf. This service is included in our LLC formation package, making it easy for you to get everything set up at once.

Our LLC formation service includes:

- Preparation and filing of your LLC Articles of Organization

- Registered agent service (optional)

- EIN filing (optional)

- Access to your online account with pre-populated state forms and other resources

- Notifications and updates on the status of your LLC filing

Our service fee is $25, plus the state filing fee, which varies depending on the state in which you’re forming your LLC. We also offer additional services, such as annual report filing and EIN filing, for an additional fee.

Yes, we offer annual report filing services. We can also handle your LLC’s annual renewal, which includes document management and ensuring your business remains compliant with state requirements. These services are available for an additional fee.

If you need to make changes, such as updating your registered agent or amending your Articles of Organization, we can assist with these filings as well. Contact us for details on how to proceed.

Yes, we prioritize your privacy. By using our registered agent service, you can keep your personal address off public records, helping protect your privacy.

Getting started is easy! Simply click on the “Hire Us” button, fill out a short form with your business details, and submit your payment. We’ll handle the rest and keep you informed throughout the process.

*The content provided here is for informational purposes only and should not be considered legal advice or a replacement for professional legal counsel. This information is not intended to establish, nor does your access to or use of it create, an attorney-client relationship or an accountant-client relationship. For more details, please refer to our Terms of Service.